- The S&P 500 lost more than 50% of its value during the Great Financial Crisis.

- Stocks bottomed on March 6, 2009 and put in their lowest close just three days later.

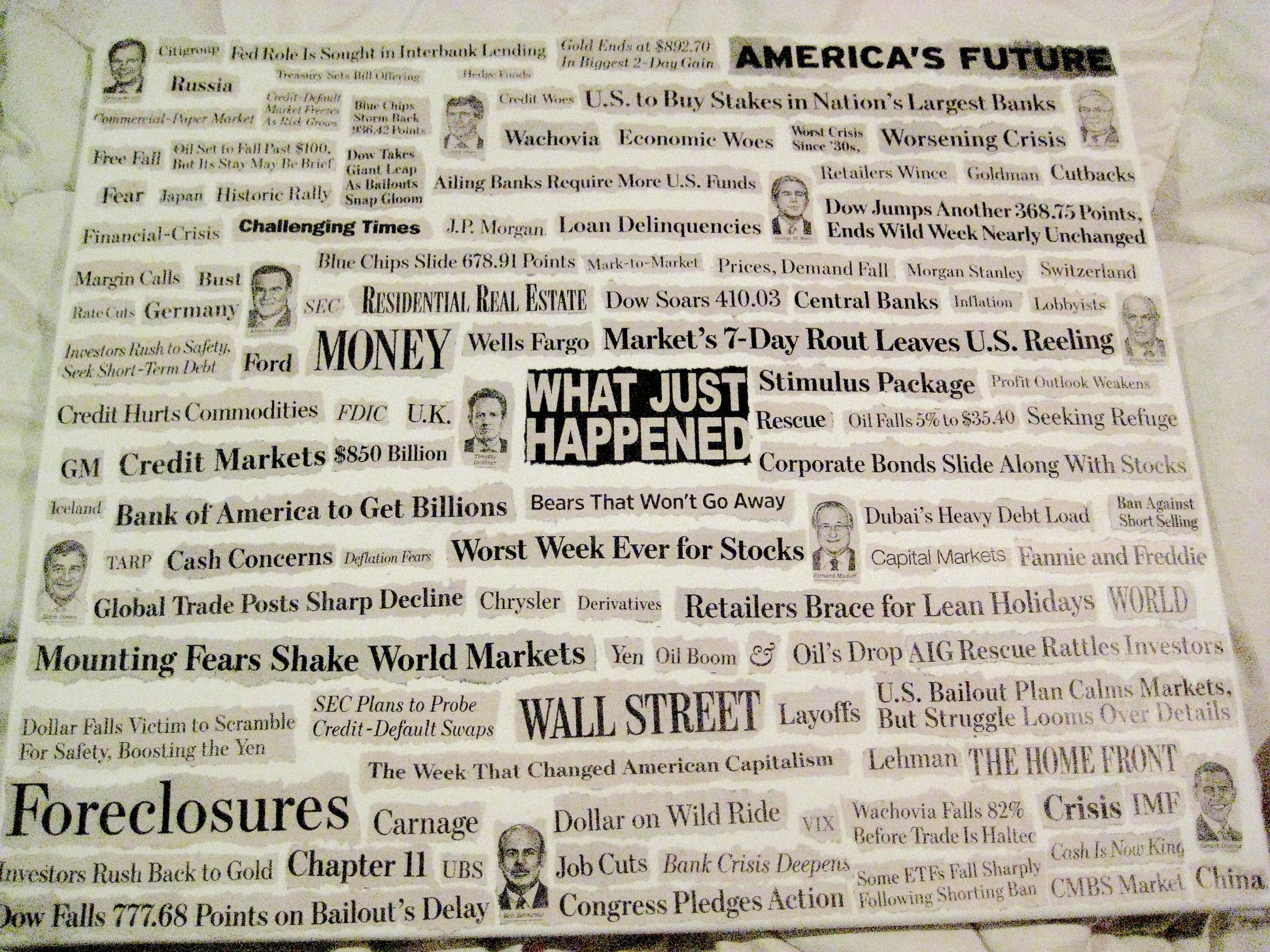

- Check out some of the headlines from the crisis.

The S&P 500 crashed more than 50% during the 2008/2009 Great Financial Crisis. Tuesday, March 6, marks the nine-year anniversary of the S&P 500’s post-financial crisis intraday low of 666. The index put in its closing low of 676.63 three days later, on March 9.

The sell-off prompted then newly elected President Barack Obama to make one of the greatest stock market calls of all-time. On March 3, 2009, Obama told America, “What you’re now seeing is profit-and-earnings ratios are starting to get to the point where buying stocks is a potentially good deal if you’ve got a long-term perspective on it.”

Since then, the S&P 500 has recovered all of its losses from the financial crisis, and then some. The nine-year rally is the second-longest bull market of all-time, and has tacked on as much as 331%, rallying to a record high of 2,872.87 on January 26, 2018.

The canvas pictured above serves as a reminder of just how scary and confusing the times were as the world became familiar with terms like mortgage-backed securities and derivatives.